Modern Contract Analysis: AI Strategies for Finance Teams

Comprehensive guide showing how AI transforms contract analysis for finance teams, reducing review time by 60-75% while improving accuracy and compliance. Covers implementation strategies, success metrics, and practical tips for deploying AI-powered contract intelligence tools.

Three months ago, Sarah Chen, CFO of a mid-sized SaaS company, was drowning in contracts at the end of the month, a nightmare every finance leader dreads.

Her team combed through each one manually, hunting for revenue recognition terms, double-checking performance obligations, and updating revenue schedules line by line.

The work dragged on for days, only to end with errors that auditors flagged again and again.

A big part of the problem lives inside contracts. Long and messy agreements, non-standard clauses, and tiny obligations that are easy to miss. Another part comes from manual reviews, which take forever, are prone to errors, and often leave finance teams scrambling to line everything up with accounting rules.

Stepping up to transform contract review is AI. It quickly reads contracts, highlights key dates and terms, flags non-standard terms, and helps companies cut errors, speed reviews, trust their numbers, and get clarity through citations.

If you work in finance, you know contracts aren’t just stacks of legal language, they’re the playbook for your numbers. They decide when you can book revenue, when money moves in or out, what risks you’re on the hook for, and which obligations you’ve got to keep an eye on over time.

But under the traditional (non-AI) model, contract analysis is a slog:

- Manual review eats up hours: Every contract, amendment, or addendum has to be opened, read line by line, and checked twice. For finance teams managing hundreds of agreements a year, that’s a huge time sink.

- Deal cycles slow down: Even when sales are ready to close the deal, finance is still hunting for renewal terms, penalties, or billing details buried in the contract, slowing everything down and frustrating teams.

- Compliance gets bottlenecked: Standards like ASC 606 and ASC 842 come down to the fine print in contracts. Miss a clause, and you could end up misreporting revenue or lease obligations, a real headache when audit season rolls around.

- Obligations slip through: Renewals, penalty dates, small but important tasks, it’s easy for these details to get lost. It’s not that people are careless, it’s that tracking everything manually is nearly impossible.

- Finance and legal don’t sync: Contracts often sit in legal’s folder or procurement’s drive. By the time finance gets them, it’s usually late, messy, and full of mismatches with invoices or POs.

And generic AI against purpose-built AI for finance

The old way meant a mountain of paperwork. The AI way trims down what used to take days to minutes. How? AI can pull out the essentials like contract value, renewal dates, performance obligations, and penalties in seconds, no line-by-line grind for your team.

But if you think any generative AI tool can do this, think again. Extraction is just the beginning, and only an AI that’s built for finance teams can really take it further.

They take a step ahead to connect the dots between master agreements, SOWs, purchase orders, and invoices automatically. This context helps spot mismatches before they derail reporting. For instance, if a supplier contract includes a performance clause or renewal term buried in the fine print, AI flags it early, linking it to related documents like the SOW or invoice, so finance and legal stay aligned.

Audit season also looks entirely different under a purpose-built AI model. Every extracted term is backed by an audit trail that points directly to the original clause, giving auditors clarity and reducing back-and-forth. Instead of scrambling to reconcile spreadsheets, finance can hand over a defensible, clause-level record of how revenue recognition or lease accounting decisions were made.

With finance-specific tools like Numero AI, finance teams can finally get through hundreds of contracts without burning out, keep compliance in check without constant fire drills, and spend their energy on tricky calls and gray areas that need real expertise. It’s a far cry from the slow, error-prone grind of manual review, and feels less like drowning in paperwork and more like finally getting your head above water.

Finance leaders need a clear case for why this is a good idea. To build that, they have to consider the size of the problem, the benefits AI can offer, and if it's actually realistic to implement it.

The business case

Start by looking at the pain of manual contract work. How many hours does your team spend digging through agreements? What’s the cost of missed renewals or overlooked clauses? How often do audits flag issues because contract data isn’t complete?

Now imagine that across hundreds or even thousands of contracts a year. The costs add up fast, not just in wasted effort, but in delayed deals, compliance risks, and missed opportunities.

AI value proposition

When AI helps with contracts, the benefits are easy to spot. It reviews documents faster, interprets them consistently, and makes fewer mistakes. This lets teams handle a much higher volume of work without having to hire more people.

AI can spot the key terms in seconds, point out clauses that could cause compliance trouble, and hand finance teams the answers they need right on the spot. The payoff shows up quickly with faster turnaround, smoother audit trails, fewer risks, and business decisions made with real confidence.

Implementation feasibility

Of course, feasibility matters. For AI to actually deliver value, contracts need to be accessible in a digital format. Even if they start as paper documents, they can be scanned and processed with OCR to make them machine-readable. AII should also plug right into the tools you already use, and your team has to be ready to adjust the way they work.

ROI

Finally, let’s talk ROI. A smart AI rollout usually pays for itself pretty quickly by saving time, keeping compliance airtight, and preventing mistakes. Plus, staying on top of compliance and deadlines can save the business a ton of money.

The real trick is to look beyond just the obvious wins, like saving hours and cutting costs and also notice the softer benefits, like quicker decisions and smoother collaboration between sales, legal, and finance.

Solutions and vendor research come second. First, finance teams need to define the problems they’re solving, the outcomes they expect, and the constraints they face.

Here’s how you can deploy AI that aligns with the realities of your financial situation and requirements:

Start with tangible benefits

Start by identifying where AI can have the biggest impact. Think time drains, bottlenecks, and compliance pain points. Then consider what success would look like and how you’d measure it. The goal is to get a clear starting point before diving into solutions.

Here are some potential benefits to keep in mind:

Overcome implementation challenges

Adopting AI isn’t just a tech decision; it starts with understanding your contracts, where they live, how complex they are, and what your team truly needs. The more clarity you have on your foundation and workflows, the easier it is for AI to plug into existing systems and deliver real value.

Here are some challenges to consider at first glance:

- Data quality: AI needs clean, accessible contract data. Expect 2–4 weeks to prepare and standardize repositories. Plan for 2-4 weeks of data preparation and standardization.

- Change management: Teams may resist AI due to job or complexity concerns. Position AI as a tool that augments human expertise and provides proper training.

- System integration: AI must work with financial systems, ERPs, and reporting workflows. Choose platforms with strong integration support and plan for technical implementation support.

- Performance validation: Finance teams need confidence in AI accuracy. Use parallel processing to compare AI outputs with manual results during transition.

Align with finance and business goals

Saving time is just one part of AI adoption; it’s also about advancing strategic finance goals. Teams need transparency, audit trails, and human oversight so outputs can be trusted and verified back to the exact contract clause.

- Strategic Business Partnership: Position AI adoption as enabling finance teams to become strategic business partners by eliminating manual work and focusing on analysis and insights.

- Scalability Preparation: As businesses grow, contract volumes increase exponentially. AI provides scalable processing capability without proportional headcount increases.

- Competitive Advantage: Faster contract processing enables more aggressive deal-making and improved customer responsiveness, creating competitive advantages that extend beyond finance efficiency.

- Risk Management Enhancement: Improved contract visibility and analysis capability strengthen enterprise risk management and compliance posture.

Measure business impact, not just efficiency

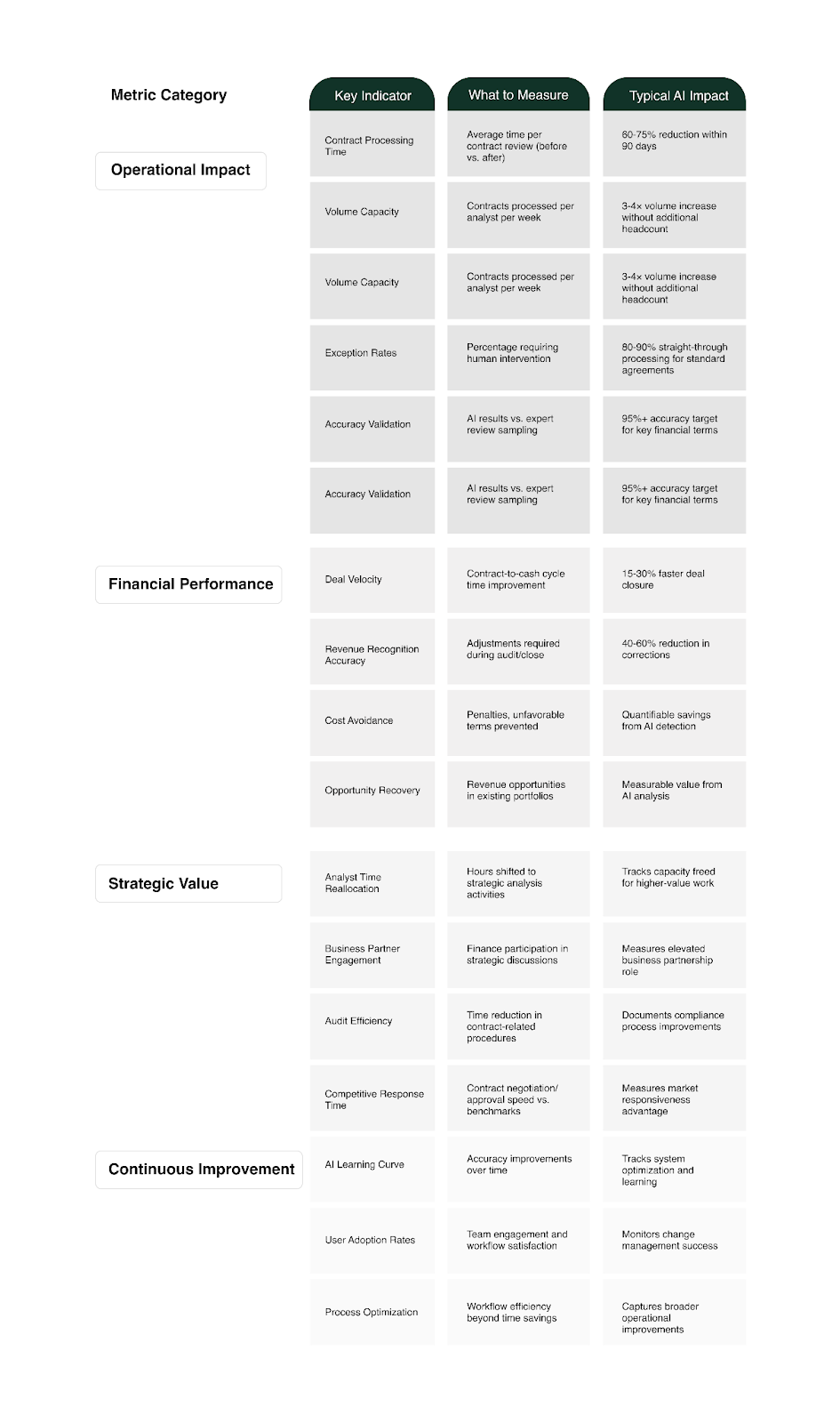

Don’t just track time saved, look at the bigger impact. These metrics show the real impact of AI in decision-making:

Even with a great strategy, success comes down to getting the details right. Here’s how to make sure you don’t miss anything important:

Keep humans in command, not just ‘in the loop’

AI should not run unchecked across revenue schedules, or you risk edge cases slipping through. Have your analysts focus on high-stakes contracts while AI takes care of the routine reviews. That’s the perfect blend of speeding up your process without losing control over critical reporting decisions.

Watch out for AI risks

Generic AI models can sometimes “hallucinate” clauses, misread obligations, or flag “phantom” penalties that waste time and worry your sales team. The fix is a finance-trained AI model that could actually recognize contract obligations and link them to accounting standards like ASC 606. With outputs tied directly to the right clauses, your team could validate results instead of second-guessing them.

Build in security and compliance from day one

Auditor pushback isn’t always about accuracy, it often comes from weak security or missing controls. Make sure you switch to an AI system with encryption, role-based permissions, and compliance-ready workflows that meet enterprise-level security standards and align with GDPR, SOX, and local data regulations.

Make audit trails your ally

Your team must be able to trace any recognition decision back to the exact clause. For example, show that revenue recognition followed a milestone acceptance in an SOW, or that a lease payment was treated as a liability under ASC 842 because a specific clause requires it. Pick a tool that links every extracted term directly to its source.

Start small, then expand

Don’t try to automate everything at once. Pick a focused set of contracts like vendor renewals, and use the success to build leadership buy-in, then expand into leases, customer agreements, and procurement contracts.

Think scale from the start

AI shouldn’t just fix one bottleneck, it should grow with you. Once it works for one contract type, it can extend across customer deals, vendor agreements, leases, and more, keeping outputs consistent and audit-ready.

Finance teams need more than text extraction. They need intelligence built for their world.

Finance-grade AI like Numero.io delivers accuracy, audit trails, and compliance-first logic in every review. Clauses aren’t just extracted; they’re linked to revenue recognition rules, connected to invoices or POs, and flagged for financial risk before they turn into surprises.

The platform handles everything from deep analysis of a single document to mass extraction across hundreds of agreements, automatically classifying contract types, pulling out key financial terms, and mapping relationships between related documents.

There’s more. Numero.io checks contracts against your CRM and ERP data to make sure everything lines up. Plus, with built-in SEC research and GAAP guidance, your terms are always accounting-ready. Add enterprise-grade security and seamless integrations, and your team stays audit-ready, accurate, and fully in control.

Want to level up your contract analysis with AI? Book a demo with Numero today!

Frequently Asked Questions

When can finance teams expect to see a return on investment from AI contract analysis?

Most teams notice that they save time right away, in the first month. Quantifiable ROI usually shows up in the first quarter, when teams finish their first full close cycle with AI help.

What kinds of contracts and languages work best with AI analysis?

Word documents, PDFs, and scanned images can all be processed by modern platforms. English contracts are the most accurate, and Spanish, French, and German business documents are also very accurate. Confidence scoring helps find parts that need to be looked at by a person.

What should teams do about changes and additions to contracts?

Leading platforms automatically connect changes to parent contracts and find changes that affect financial terms. The finance team needs to look over any changes to the revenue schedule, prices, or terms. This is very important for ASC 606 compliance.

How accurate should finance teams expect things to be?

Well-trained systems keep over 95% accuracy for standard revenue recognition terms. They also have confidence scoring that helps find complicated clauses that need to be reviewed by a human.

How does AI contract analysis work with other systems?

Look for platforms that have built-in connectors for common ERP and CRM systems, as well as API access for custom integrations. Revenue schedules, accounts payable workflows, and reporting dashboards should all automatically get contract data.

Trained by accounting experts for finance professionals

Designed for CFOs, controllers, FP&A, and audit teams, the Numero AI has built-in logic for financials, compliance, and reporting.